Upwork is a popular platform for freelancers and independent contractors to find work and connect with clients from around the world. If you’ve earned income through Upwork, you may need to report it on your taxes, and to do so, you’ll require a Form 1099. In this guide, we’ll walk you through the process of obtaining your 1099 from Upwork so you can ensure compliance with tax regulations.

Understanding the 1099 Form:

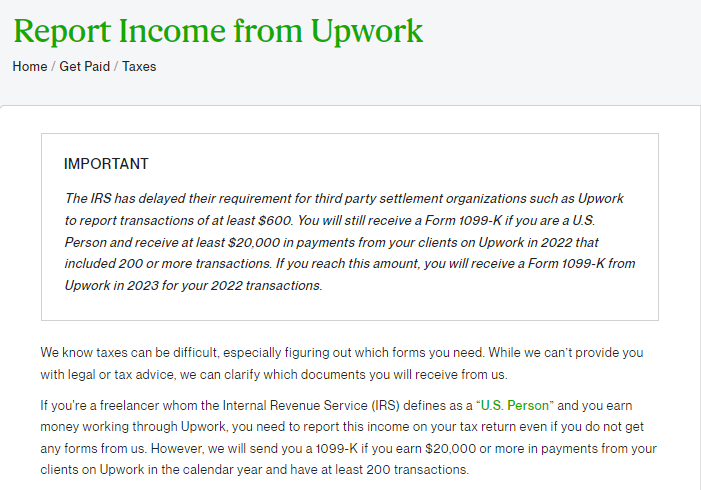

Before we delve into the steps of obtaining your 1099 from Upwork, let’s briefly understand what this form is. The Form 1099 is used by businesses and platforms like Upwork to report various types of income to the Internal Revenue Service (IRS) in the United States. It is essential for freelancers, as it helps them report their earnings and pay their taxes accurately.

Eligibility for a 1099 from Upwork:

Not every Upwork user will receive a 1099. Upwork issues 1099-MISC forms to freelancers who meet certain criteria:

Earnings Threshold:

You must have earned at least $600 or more through Upwork in a calendar year to qualify for a 1099.

U.S. Taxpayer Status:

If you are a U.S. taxpayer, you may receive a 1099 from Upwork. International freelancers may receive a 1042-S form instead.

Completed W-9 Form:

Ensure you have submitted a completed W-9 form to Upwork with accurate taxpayer information. This form is essential for Upwork to report your earnings to the IRS.

Steps to Obtain Your 1099 from Upwork:

Now, let’s go through the steps to obtain your 1099 form from Upwork:

Log into Your Upwork Account:

Visit the Upwork website and log in to your freelancer account using your credentials.

Access Your Reports:

Once logged in, navigate to the “Reports” tab, which is usually located under the “Transactions” section.

Select Tax Documents:

Look for the “Tax Documents” option and click on it. This is where you will find your 1099 forms.

Download Your 1099:

Find the tax year for which you need the 1099 form and click on the corresponding link to download it. Upwork typically makes these forms available in January of the following year.

Review and Verify Information:

Ensure that all the information on the 1099 is accurate. Double-check your name, Social Security Number (or Taxpayer Identification Number), and the earnings reported. If you spot any errors, contact Upwork support for assistance.

Keep a Copy:

It’s essential to keep a copy of your 1099 for your records, as well as any other supporting documents related to your income and expenses.

Conclusion:

Obtaining your 1099 from Upwork is a crucial step in fulfilling your tax obligations as a freelancer. By following the steps outlined in this guide and ensuring that your information is accurate, you can confidently report your earnings to the IRS and avoid potential tax issues. Remember that tax regulations can change, so it’s always a good idea to consult with a tax professional for the most up-to-date guidance regarding your specific tax situation.

What is a Form 1099, and why do I need it from Upwork?

A Form 1099 is used to report income for tax purposes. If you earn income through Upwork, you may need it to accurately report your earnings to the IRS.

Do I automatically receive a 1099 from Upwork?

Answer: No, not every Upwork user automatically receives a 1099. There are specific eligibility criteria that must be met.

How much do I need to earn on Upwork to qualify for a 1099?

Answer: To qualify for a 1099 from Upwork, you must have earned at least $600 or more in a calendar year.

I’m an international freelancer. What tax form will I receive from Upwork?

International freelancers may receive a 1042-S form from Upwork instead of a 1099-MISC.

What is a W-9 form, and why do I need to submit it to Upwork?

A W-9 form is used to collect your taxpayer information. Upwork requires it to accurately report your earnings to the IRS.

When can I expect to download my 1099 form from Upwork?

Answer: Upwork typically makes 1099 forms available for download in January of the following year.

Can I make corrections to my 1099 form if I spot errors?

If you find errors on your 1099 form, contact Upwork support for assistance in making corrections.

Is it necessary to keep a copy of my 1099 and other financial documents?

Answer: Yes, it’s essential to keep copies of your 1099 and any supporting documents for your tax records.